This is continued from PART 1

Here’s how it works out…

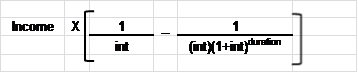

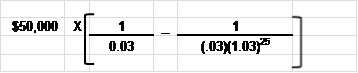

Let’s assume that the breadwinner earns $50,000 each year. We will use the income approach to determine the amount of coverage needed on his life. The duration of the risk is 25 years and the assumed interest rate is 3% (this is the inflation adjusted rate of return on the funds used to provide the family with income for the 25 years).

Needed Coverage:

=$870,000 (approx.)

The same formula is used for the expense approach with the only difference being that the total annual identified expenses are multiplied by the factor above.

Should I use NET or GROSS income to calculate this?…for this reason is generally safe to now take off 30% (rule of thumb) of the $870,000 to bring us to a rounded total need of $610,000. So we will apply for coverage of $610,000. This will ensure that there will be adequate funds for the family to have the same net cash flow for 25 years should the breadwinner pass away.

The Bottom Line

So you should now have a good idea of how to identify the risks and calculate the amount of insurance need to address them Once you have the right amount of insurance in place using a trustworthy advisor, then you and your family can take comfort in knowing that your needs will be met should a spouse die prematurely. The information in this article will empower you to avoid being “upsold” more insurance than you need, or protect you from being ill advised with an inadequate life insurance portfolio.

By Jonathan at www.CanadianLifeQuotes.com

jonathan@canadianlifequotes.com

E.&O.E

*This article is for information purposes only and is not intended as specific advice for any individual. Please review your policy contract for complete details of your existing coverage and speak with a licensed professional if you have any questions or concerns.